For decades, IWC Schaffhausen has been synonymous with precision, luxury, and timeless design. Known for their impeccable craftsmanship and innovative engineering, IWC watches have captivated collectors and horology enthusiasts worldwide. But beyond their aesthetic and functional appeal, are IWC watches a good investment? In this article, we’ll explore the value of IWC watches, their place in the luxury market, and what makes them a promising addition to any collection.

Understanding the Legacy of IWC Schaffhausen

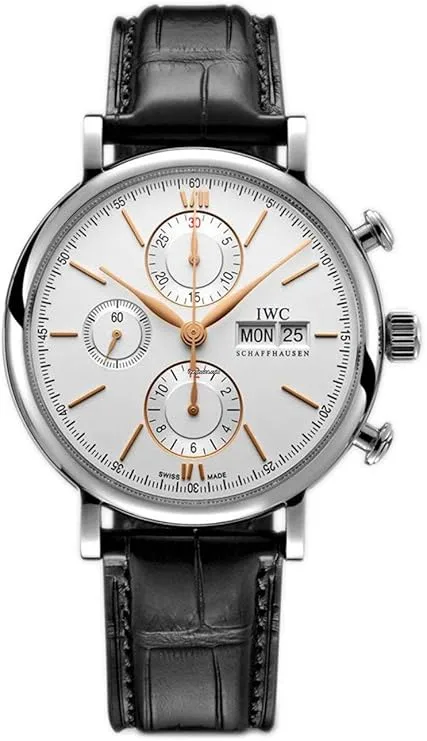

Founded in 1868 in Schaffhausen, Switzerland, IWC (International Watch Company) has earned a reputation for creating high-quality timepieces that combine elegance with functionality. Iconic collections like the Pilot’s Watch, Portugieser, Da Vinci, and Aquatimer showcase the brand’s versatility and commitment to innovation. Each collection tells a story, appealing to a wide range of tastes and preferences.

The Pilot’s Watch, for instance, is celebrated for its robust design and precision, making it a favorite among aviation enthusiasts. Meanwhile, the Portugieser Collection offers timeless sophistication, with designs that embody classic Swiss watchmaking.

Factors That Influence IWC Watches Value

When assessing whether IWC watches are a good investment, it’s important to consider several factors that impact their value:

1. Rarity and Limited Editions

IWC regularly releases limited-edition models, which tend to appreciate over time due to their exclusivity. For example, models like the IWC Big Pilot’s Watch Perpetual Calendar Top Gun have become collector’s items, commanding high prices in the resale market.

2. Craftsmanship and Movements

The quality of IWC’s in-house movements, such as the Caliber 89000 series or the Caliber 52010, significantly contributes to their value. These movements are renowned for their precision, durability, and innovative features, making them highly desirable among watch enthusiasts.

3. Condition and Authenticity

Well-maintained IWC watches with original components, including the dial, case, and movement, retain their value better than heavily modified or worn pieces. Authenticity is crucial, as counterfeit luxury watches can flood the market.

4. Historical Significance

Certain IWC models, such as the Mark XI Pilot’s Watch, hold historical significance, further enhancing their appeal to collectors. These watches are not only functional but also serve as a piece of horological history.

5. Market Demand

The luxury watch market has seen consistent growth, with IWC maintaining a strong position among top-tier brands like Rolex and Patek Philippe. High demand for iconic models drives their resale value and investment potential.

Iconic IWC Models Worth Investing In

If you’re considering investing in IWC watches, here are some standout models to keep on your radar:

- IWC Portugieser Automatic (Ref. IW5007): Known for its clean design and seven-day power reserve, this model exemplifies timeless elegance.

- IWC Big Pilot’s Watch (Ref. IW501001): A classic aviation-inspired piece with a bold design and exceptional craftsmanship.

- IWC Aquatimer Chronograph (Ref. IW376804): Perfect for diving enthusiasts, this model combines durability with sleek aesthetics.

- IWC Da Vinci Perpetual Calendar Chronograph (Ref. IW392101): A masterpiece of complexity and artistry, showcasing IWC’s technical prowess.

- IWC Mark XVIII Pilot’s Watch: A modern interpretation of the iconic Mark XI, offering understated sophistication.

Tips for Investing in IWC Watches

To make the most of your investment in IWC watches, consider the following tips:

1. Research Market Trends

Stay updated on market trends and demand for specific IWC models. Limited editions and vintage pieces often see higher appreciation over time.

2. Verify Serial Numbers

Check the serial number of the watch to ensure its authenticity and to gather information about its production date and history.

3. Buy from Trusted Sources

Purchase IWC watches from reputable dealers, auctions, or certified resellers to avoid counterfeit items.

4. Focus on Condition

Watches in excellent condition, with original documentation and boxes, typically retain higher resale value.

5. Diversify Your Collection

Consider adding a mix of classic and limited-edition IWC models to your collection to balance potential risks and rewards.

The Investment Potential of IWC Watches

IWC watches combine heritage, craftsmanship, and exclusivity, making them a strong contender in the luxury watch investment market. While they may not appreciate as rapidly as brands like Rolex, their steady demand and timeless appeal ensure long-term value. Vintage IWC models, in particular, have shown significant growth in value, especially those with historical significance or rare features.

Conclusion

IWC watches are more than just luxury accessories; they are investments in artistry and history. Whether you’re drawn to the rugged charm of the Pilot’s Watch or the refined elegance of the Portugieser, IWC offers something for every collector. By focusing on key factors such as rarity, craftsmanship, and condition, you can make informed decisions and uncover opportunities for appreciation in value. For those seeking a blend of style and investment potential, IWC watches are undoubtedly worth considering.

1 thought on “IWC Watches Value: Are They a Good Investment?”